Case Study: Convention Center Discovered Much-Needed AP Efficiency and Cash-Back Benefits

AP Spend Analysis Demonstrates New Sources of Revenue from Cash-Back Incentives

The CHALLENGE

The COVID-19 virus crisis poses a challenging situation for convention centers and venue managers nationwide.Discovering overlooked opportunities in AP spend, they reduce operational costs and benefit from cash back.

One of the largest convention destinations on the West Coast engaged Priority Commercial Payments to conduct an accounts payable analysis. Their goal: uncovering cost-reduction opportunities and identifying how much annual accounts payable spending could be converted to rebate-eligible payment methods.

The SOLUTION

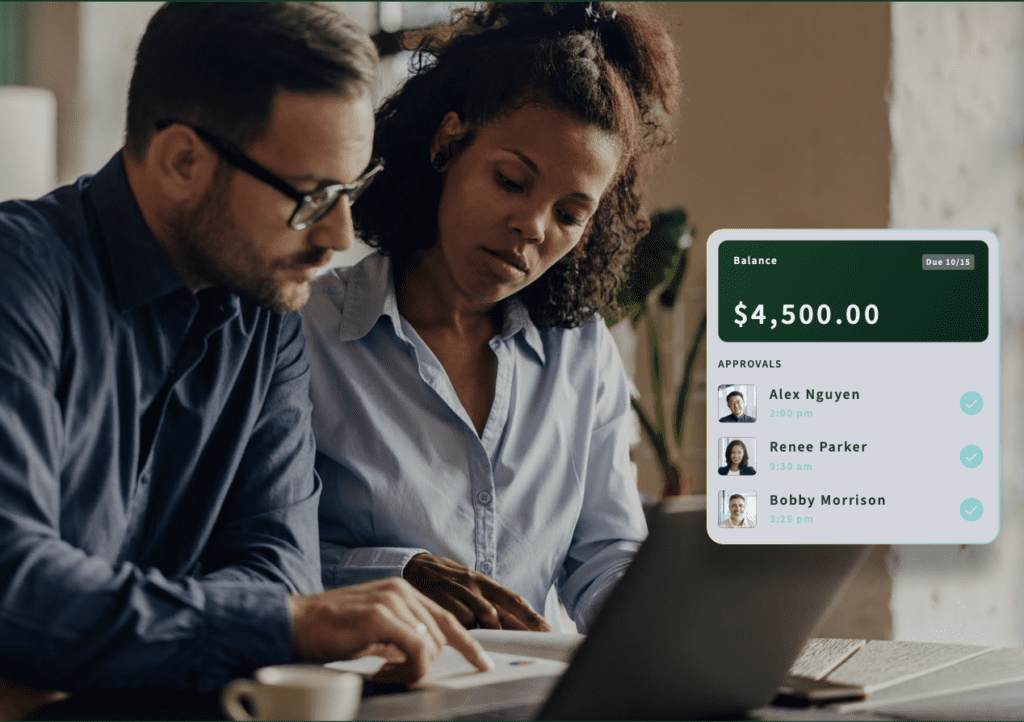

Priority Commercial Payments analyzed the convention center’s spend volume. As well as this Priority investigated various payment types against the suite of solutions available through Priority’s CPX platform.

Various payment types are eligible for rebates. This includes a number of Visa virtual card solutions and an ACH+ payment option primarily designed for convention center suppliers with large invoice amounts. ACH+ offers suppliers an option to accept ACH payments with fees based on basis points.

In addition to cash-back opportunities, Priority demonstrated that CPX is capable of much more. Automating and integrating 100% of payments issued by the convention center regardless of the payment type, is saves so much hassle. In other words card, ACH, dynamic discounting, proxy payments, wire or check automation are all easily integratable and automated.

With little or no upfront start-up costs, and no changes existing accounting system, Priority’s single Payment Instruction File (PIF) makes implementing the Priority CPX solution a quick and easy way for convention centers and event venues to reduce inefficiencies, errors and reconciliation work associated with accounts payable. Thought it couldn’t get better? The Priority Commercial Acceptance team identifies opportunity to gain monthly cash-back benefits on behalf of convention centers and event venues. Priority does the work!

The RESULTS

- Annual Spend Targeted for Conversion to Rebate-Eligible Spend: 39% of Spend File

- Cash-Back Benefit with Participating Vendors: 1.1% (110 basis points) of Spend

- Benefit to Convert Check Payments to Processing Through CPX: $12,000 Annual Savings

- Estimated Annual Benefit (Savings) from Using CPX Integrated Payables: $100,000+

For this convention center, the analysis indicates 39% annual vendor spend was converted to a rebate-eligible payment method. In this case, Priority estimates the convention center could realize a 1.1% cash-back benefit with spend amount of participating vendors.

Eliminating the burdensome process of preparing, approving, signing and mailing checks is estimated to save at least $5.00 per check. Ultimately translating to a direct cost reduction for the subject convention center of $12,000 per year.

What is the bottom line? The analysis produced an estimated benefit of over $100,000 per year by moving beyond labor-intensive and disparate accounts payable tools to the CPX Integrated Payments solution.

The meaningful financial benefits through utilization of Priority Commercial Payments’ CPX platform could enable organizations like this convention center to weather the business disruption. On top of this, there achieving better positioned in the rebound to invest in additional staff resources, cover operating costs or establish a rainy-day fund for future unexpected expenses.

Contact us to request an AP spend analysis, or watch this short video that explains how integrated payables work.