Payments and banking designed to work for any business.

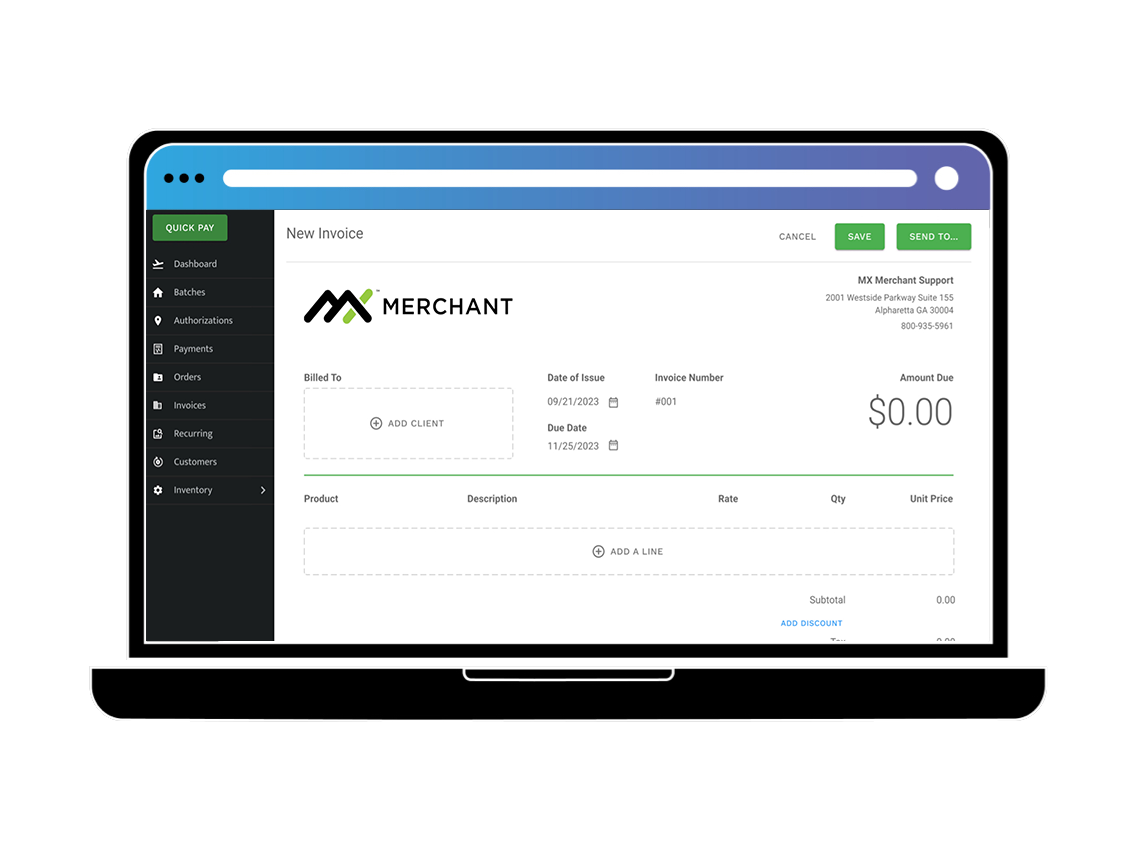

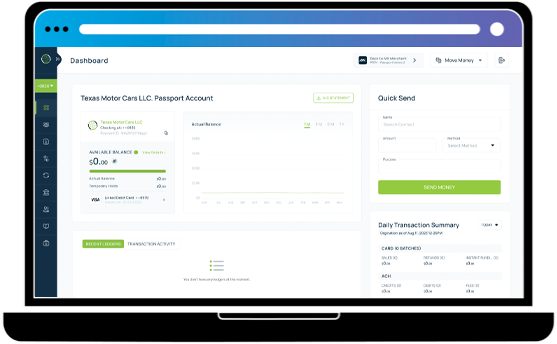

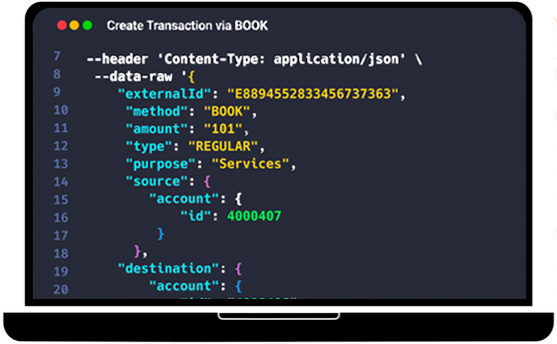

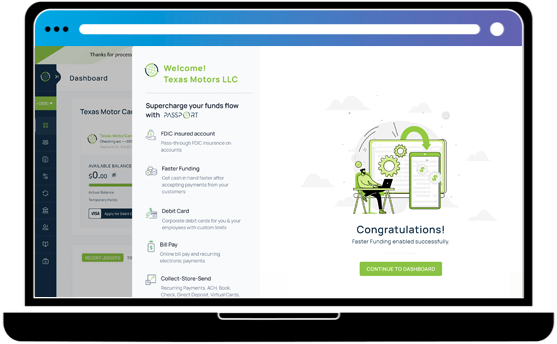

Use our API suite to accelerate payments through your own application, or use our standalone platform to run every transaction your business depends on. Easily integrate cash flow management, banking and treasury services, and compliance, reporting and business intelligence. Collect, store and send money on a single native platform.

Our consulting team is standing by to show you how it can completely transform your financial operations.

Routable FDIC insured accounts under our nationwide MTL and transaction APIs

The industry’s only complete native payments and banking solution for virtually any instrument

Reduce friction and automate operations to save time, labor and money

Turn transactions into cash flow by monetizing the payment process and adding revenue to your bottom line

Transparent dashboards allow intuitive access, control and reporting of every penny that moves