Streamline revenue and accelerate growth with the Priority Commerce Engine (PCE)

Get started

Enable faster and more flexible payment processing. Priority automates 100% of your accounts payable to ensure timely payments, strengthen business relationships, and speed up payment cycles. Same-day funding and multiple payment routes connect you to cash faster, so you can seize opportunities now.

Get big bank services with real speed and agility. Gain easier access to funds with Priority Capital and stretch cash further with flexible payment options. Pay vendors how you want, even with methods that they don’t traditionally accept. And because Priority connects acquiring and payments partners in the same platform, you can minimize friction.

Our platform and team of experts help cut costs wherever possible. Automated transactions, fund transfers, and account management saves time, reduces errors, and saves money across your organization. Find additional savings in reduced processing fees and cash back — while improving financial wellness with solutions like CFTPay.

Collect, store, lend, and send money in one platform. Priority Commerce Engine integrates multiple financial services to reduce complexity, simplify operations, and enhance efficiency. Access a comprehensive view of your business — including billings, sales tracking, and customer engagement data — to best inform your next move.

Highly configurable and easy to use, our commerce engine enables financial agility and operational stability for today’s fastest-growing enterprises.

Expedite development with secure, feature-rich APIs that boost savings, flexibility, and scalability.

Empower business banking customers to grow with a white-labeled banking technology solution.

Discover new opportunities and maximize efficiency with our fully integrated payments platform.

The path to financial success is seldom linear. Our innovative strategies and creative approach empowers your team to eliminate barriers to growth and redefine the future of your business.

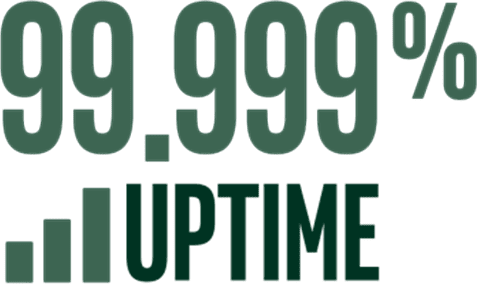

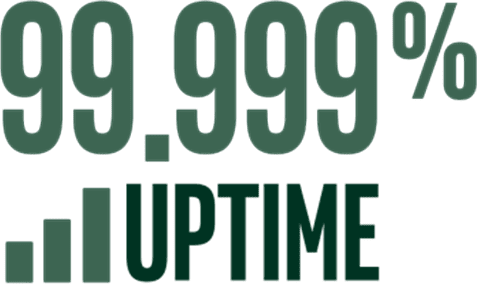

Built to enable total visibility, our robust security measures reduce the risk of fraud, ensure compliance with regulatory standards like HIPAA and PCI, empower you to operate at nine times your initial uptime, and put you in control.

Discover the insights, trends, and practical advice to accelerate cash flow and optimize working capital.

Unified commerce is a connected commerce strategy that combines all sales channels, customer data and back-office tools into a single system. With everything updated in real time, businesses can deliver a consistent customer experience across in-store, online and mobile shopping. When powered by the Priority Commerce Engine, this approach also enables companies to monetize commerce operations by integrating payment processing, fund management and capital access, turning every transaction into a financial advantage.

Omnichannel and unified commerce both aim to give customers a consistent experience across stores, websites and on mobile. The difference is how the systems behind the scenes are set up. Omnichannel often uses separate tools that don’t always work together in real time, which can lead to delays or errors. Unified commerce runs everything through one connected system. This helps teams work more efficiently and gives customers a smoother experience, no matter where they shop.

The Priority Commerce Engine helps businesses monetize every stage of the commerce journey by integrating financial services directly into the unified commerce platform. This includes:

By embedding these capabilities into one connected system, Priority Commerce Engine helps businesses accelerate cash flow, optimize working capital and drive more value from every transaction.

A real-world example of unified commerce is how an events company uses Priority’s Banking & Treasury Solutions to manage finances for their music festivals. They track and manage all revenue streams, including ticket sales, sponsorships and vendor fees, and handle disbursements to artists, venues, and suppliers, all from a single platform. With each stakeholder having their own account and automated disbursement rules, the company gets full visibility and control. This unified system helps reduce errors, streamline operations, and improve both customer and team experiences.