How Does Payment Processing Work?

Priority understands that payment processing is a critical component of modern commerce. After all, it’s how our company got its start in the fintech industry.

Whether you’re buying a product online or paying for a service, payment processing is the $100 billion dollar industry behind the scenes, ensuring the transaction goes smoothly. But how does it work? Let’s take a closer look at the payment processing process and explore the various parties involved.

What is payment processing?

Payment processing is an important part of financial transactions. It helps move money between payer and payee using electronic methods. The process involves several steps to make sure the payment is valid and secure, including authorizing and verifying the transaction and then transferring the funds. Several parties, including banks and payment processors, work together to ensure transactions are completed smoothly and securely.

Why is payment processing important for businesses?

Payment processing is key for any business because it helps move money quickly and safely, making sure transactions are smooth and secure. This is crucial not only for boosting commerce but also for supporting overall economic growth. The right payment system can really shape how well a business connects with its customers and handles market demands.

Businesses depend on solid payment processing to keep cash flowing smoothly, keep customers happy, and run operations efficiently. Offering various payment options is great for catering to what customers prefer, which boosts convenience and trust. Plus, a good system helps cut down on fraud, protect data, and ensure compliance with the law.

Lately, the payment processing scene has changed a lot thanks to new technology addressing the shift in consumer behavior and how transactions are made. This shift has brought about faster, safer, and more convenient payment options, all while helping businesses stay competitive and responsive to their customer needs.

Key components of how payment processing works

At its core, payment processing involves four main steps:

Authorization

When a customer initiates a payment, the payment processor contacts the customer’s bank or credit card issuer to obtain transaction authorization.

Capture

When the payment processor receives authorization, it captures the funds and holds them until the transaction is complete.

Settlement

After the transaction is complete, the payment processor settles the funds with the merchant’s bank or payment gateway.

Funding

Finally, the payment processor transfers the funds to the merchant’s account, minus any fees or commissions.

The exact process can vary depending on the payment method and the parties involved. Of course, each step involves more details. Let’s look at each one.

A deeper look into how payment processing works

Payment authorization

The payment processor first needs to obtain authorization from the customer’s bank or credit card issuer when initiating payment. This occurs through a series of messages between the payment processor and the bank, using a protocol called the Payment Card Industry Data Security Standard (PCI DSS).

As part of the authorization process, the payment processor sends the customer’s payment details and the transaction amount to the bank or credit card issuer. The bank or issuer then checks if the customer has sufficient funds or credit available, and sends an approval or denial message back to the payment processor.

Fund capture

Upon receiving authorization, the payment processor holds funds from the customer’s account until the transaction is complete. A record of the transaction is created, the funds are deducted from the customer’s account, and they are held in a temporary account until the transaction is settled.

Fund settlement

After the transaction is complete, the payment processor settles the funds with the merchant’s bank or payment gateway. Settlement involves transferring the funds from the temporary account to the merchant’s account, minus any fees or commissions charged by the payment processor.

Funding

Finally, the payment processor transfers the funds to the merchant’s account. This process is known as funding and typically takes 1-2 business days. Before transferring funds to the merchant, the payment processor may also deduct any fees or commissions.

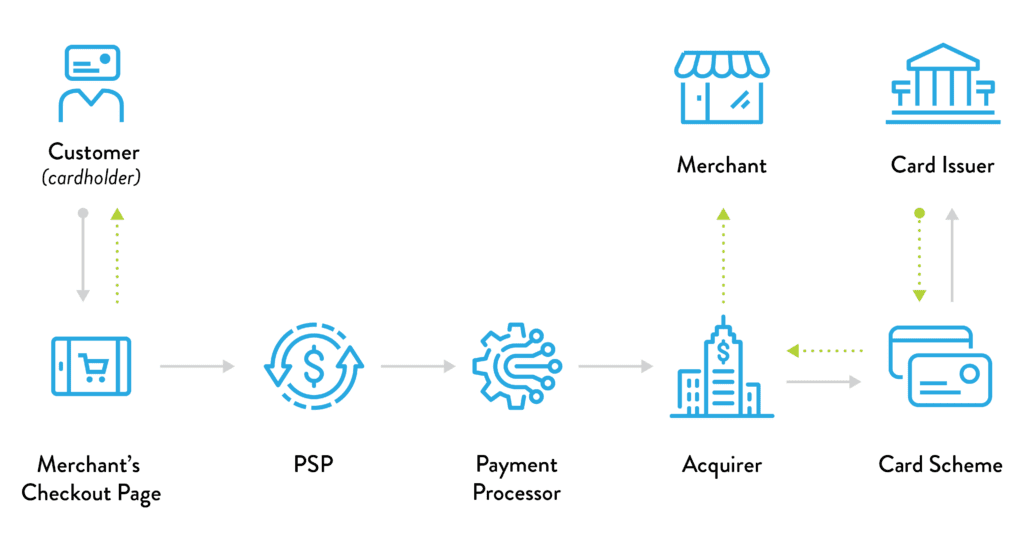

Who is involved in payment processing?

Payment processing involves several parties:

- The customer: The person paying.

- The merchant: The person or organization receiving the payment.

- The payment processor: A company that facilitates payment transactions between the merchant and the customer. The payment processor connects to payment networks, such as Visa or Mastercard, and processes payment information.

- The merchant acquirer: A financial institution that enables merchants to accept payments from customers using credit or debit cards. The merchant acquirer works with the payment processor to authorize, settle and fund transactions.

- The bank or credit card issuer: The organization that holds the customer’s funds or credit and approves or denies the transaction.

- The payment gateway: The technology that connects the payment processor to the merchant’s website or point-of-sale system.

- The acquiring bank: The bank that processes the transaction settlement and funding.

Discover the ultimate payment processing suite

Payment processing is a complex and essential part of modern commerce. From authorizing transactions to settling funds, payment processing involves multiple parties and carefully orchestrated steps. By understanding how payment processing works, merchants and customers can make informed decisions about how to handle their financial transactions. This will ensure the smooth and secure processing of their payments.

Priority’s extensive experience means we’re an outstanding resource for merchants in the SMB space who need a reliable, transparent, and future-facing payment processing partner. Whether you’re an ISO/reseller, or a merchant looking to launch a business or switch processors, Priority’s MX™ Merchant platform provides a payments ecosystem perfectly customized to your specific needs.