Accept More Payments Anywhere with ACH.COM

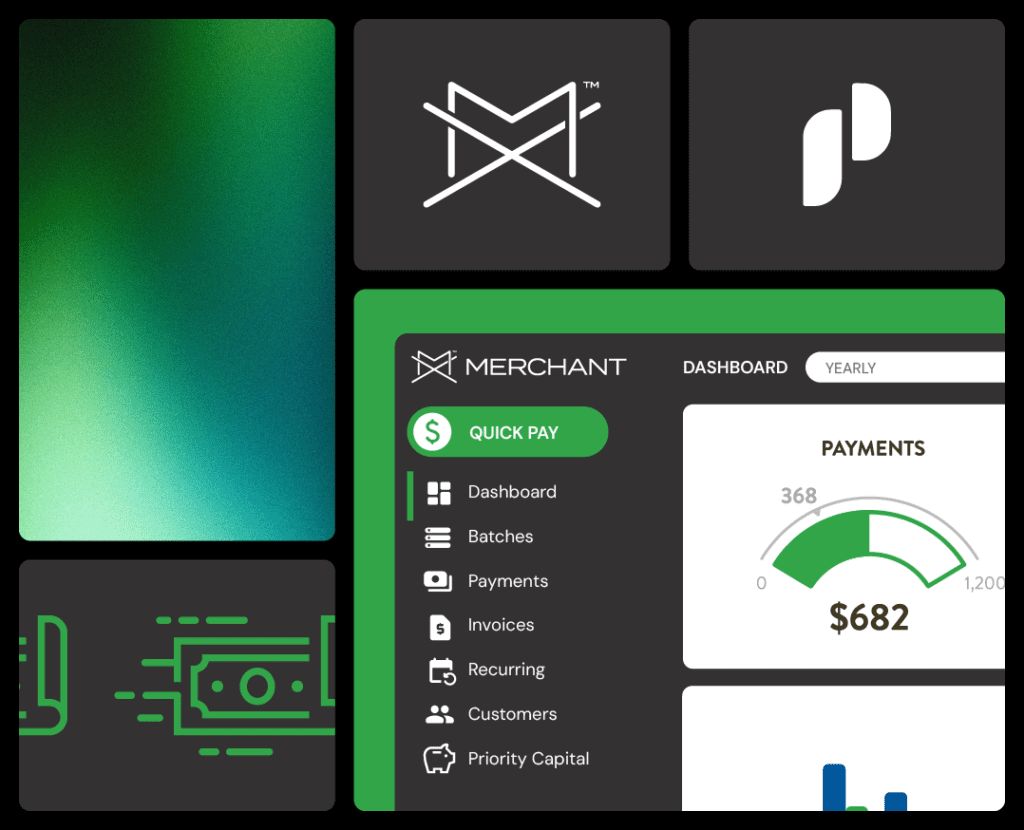

Accepting alternative forms of payment and recurring payments has never been more important for business owners. According to NACHA, the governing body for ACH payments, “steady growth continued for the ACH Network in the third quarter of 2022, with 7.6 billion payments processed valued at $19.2 trillion.” ACH.COM allows merchants to use a customer’s bank account to accept a one-time or recurring payment safely and quickly – all while minimizing paper checks and trips to the bank. Whether processing payments via the ACH.COM standalone offering or as integrated within MX™ Merchant, ACH.COM provides a cost-efficient electronic payment option and streamlines accounting operations. And, you can accept more payments anywhere with ACH.COM.

Why ACH.COM?

- ACH.COM is one of the few processors in the nation entrusted with a FED Terminal on site, which gives merchants earlier response times and exception handling with the latest cutoffs.

- ACH.COM has multiple AAPs (Accredited ACH Professionals), providing an unsurpassed level of commitment and experience.

- Reliable and real-time reporting allows merchants to measure results quickly.

ACH.COM offers a reliable, fast, and cost-effective solution for businesses to process electronic payments securely and efficiently. With ACH.COM, business owners not only streamline their payment processes but also reduce the risks associated with traditional payment methods. Additionally, ACH.COM provides real-time reporting and analytics, enabling merchants to make informed financial decisions.

Ready to accept payments anywhere with ACH.COM? Come see why ACH.COM is the right solution, offering a secure, fast, and cost-effective way to send and receive electronic payments, reducing transaction times and streamlining payment processes.

Resources

Check out the vast resources below to help merchants visualize the benefits of accepting ACH payments.