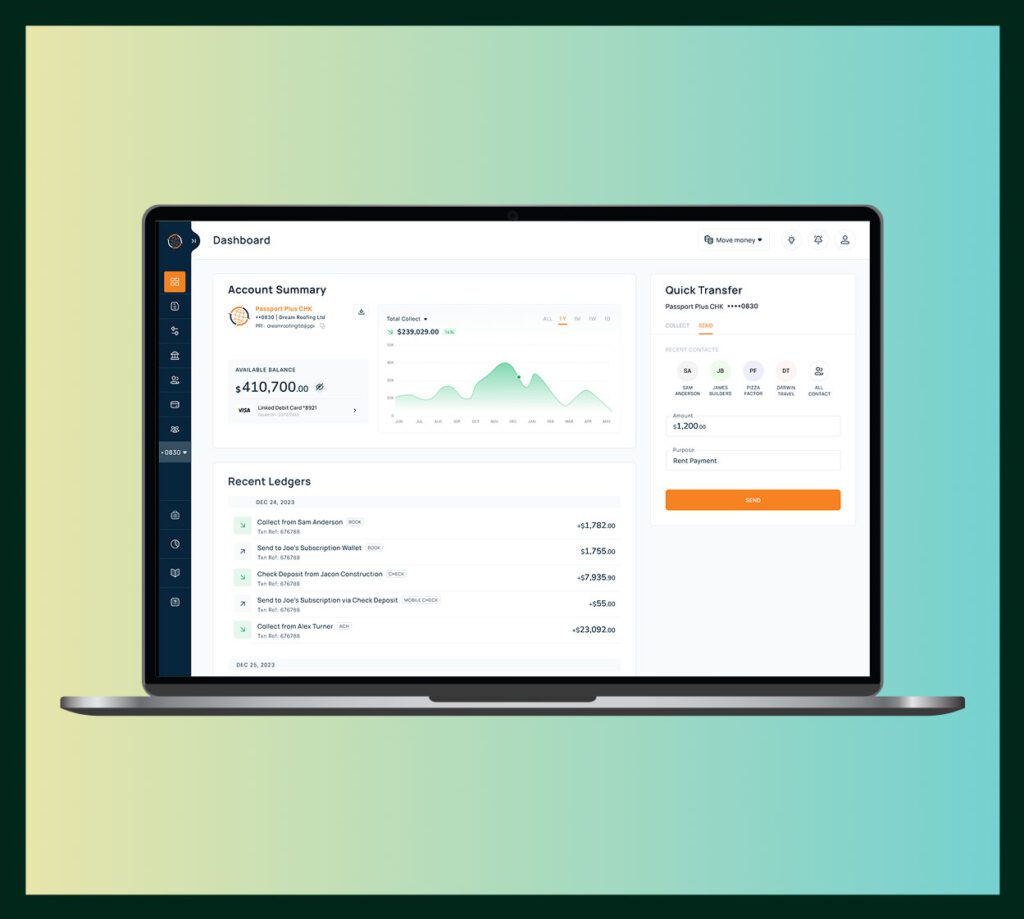

Banking and Treasury Solutions Designed to Work for Any Business

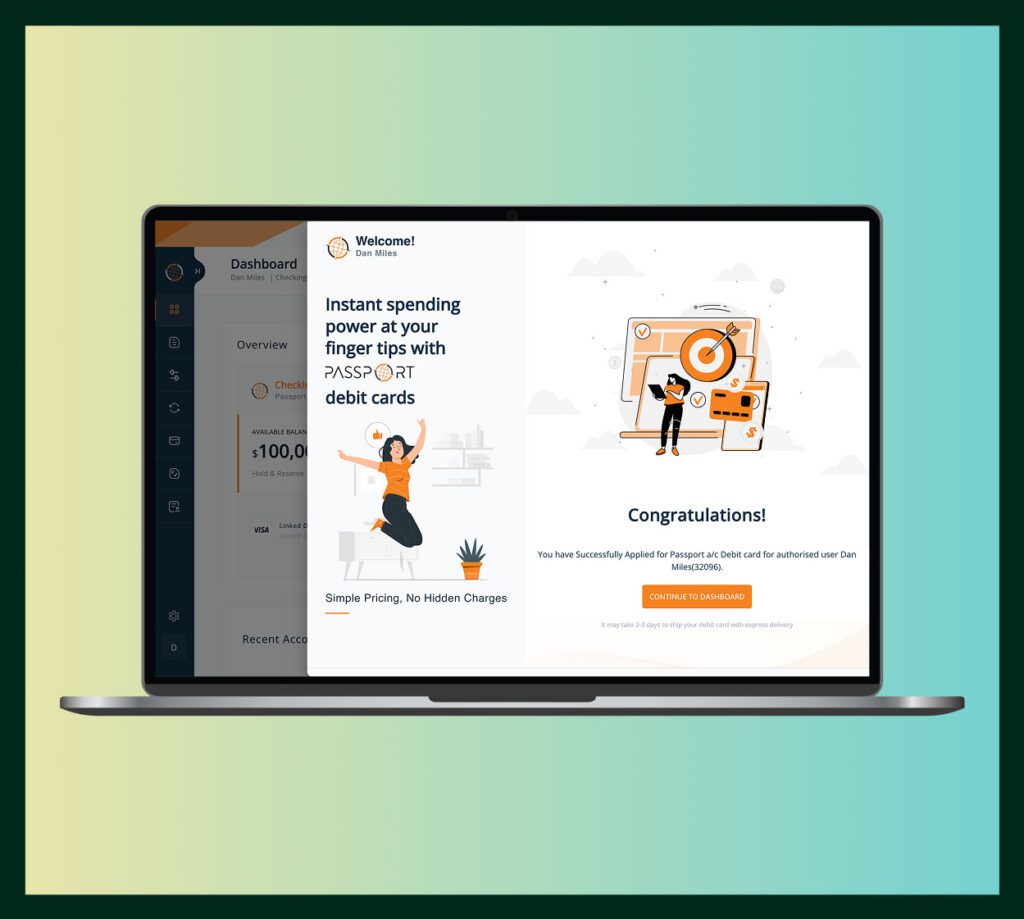

Collect, store, lend, and send money on a single native platform. Passport helps businesses of all sizes accelerate cash flow, streamline transaction reconciliation, and optimize working capital. It’s banking services designed to work for any application.

Why Use Passport’s Banking & Treasury API?

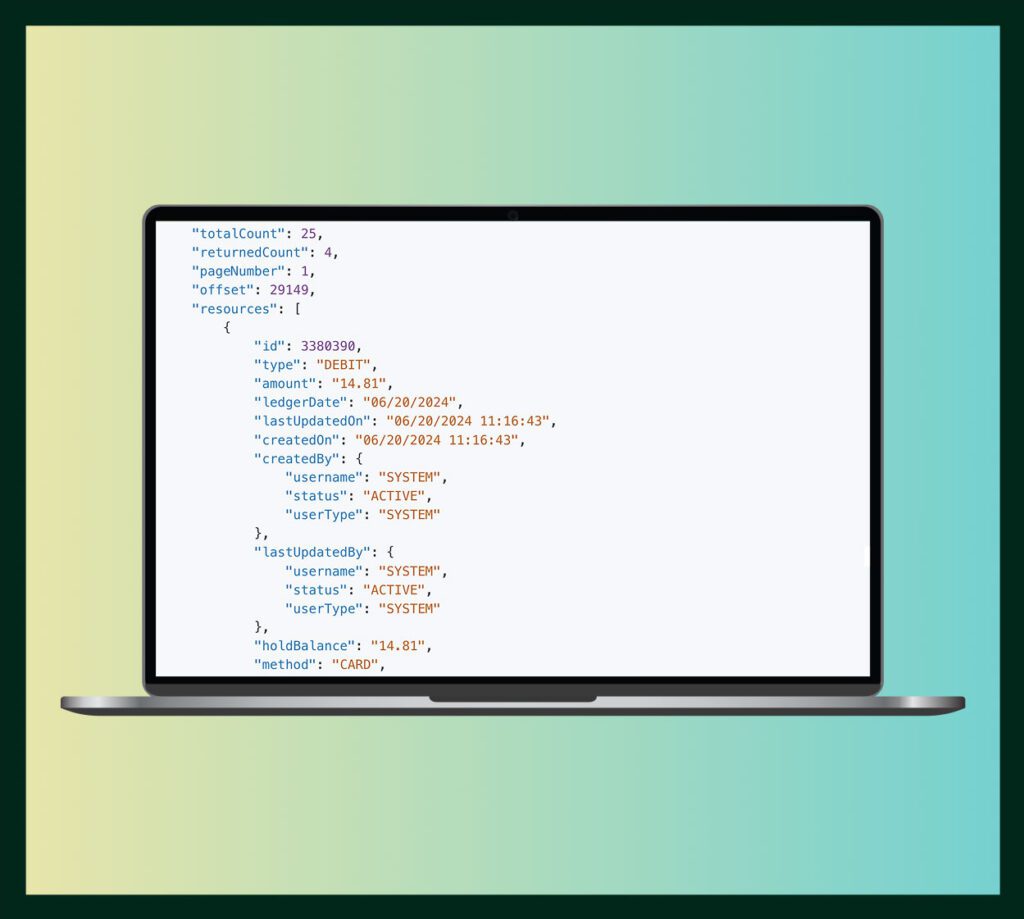

Use our API suite to integrate into your own application, or use our standalone platform to run every transaction your business depends on. Easily integrate cash flow management, banking and treasury solutions, compliance, reporting, and business intelligence (BI).

Our Priority Banking consultation team is standing by to help you achieve your financial vision.

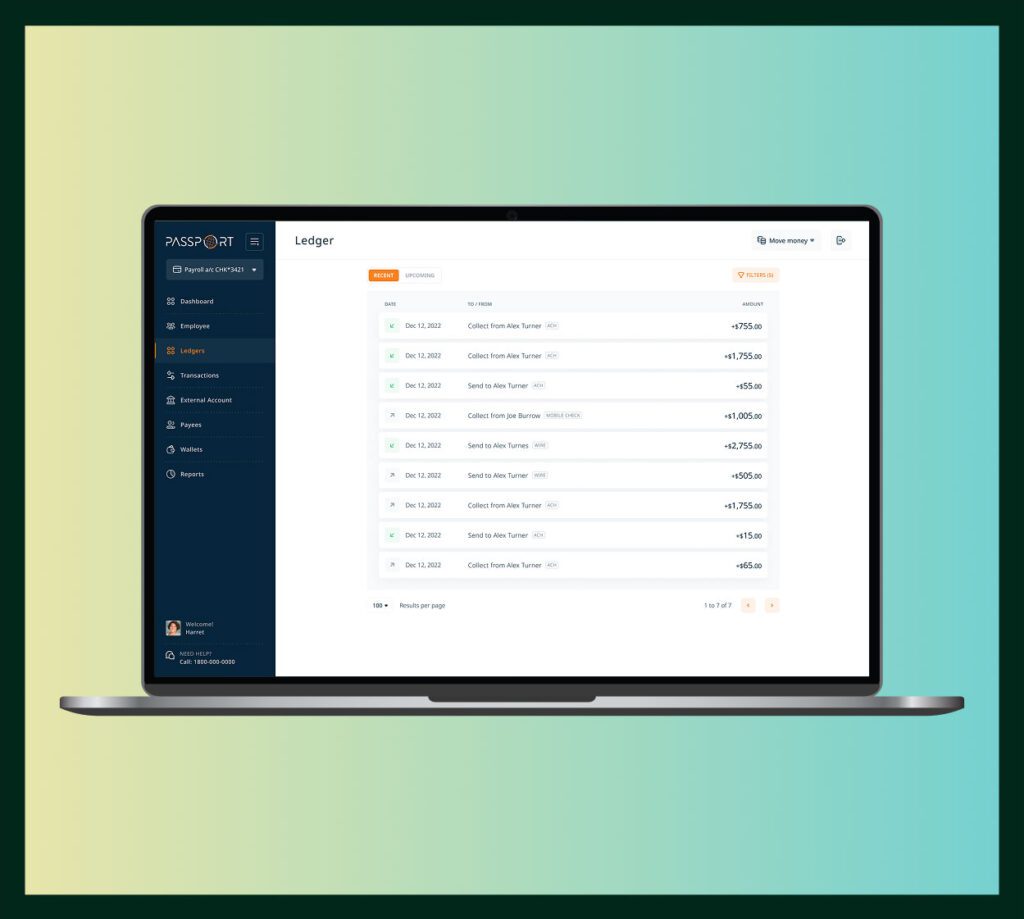

Automated Reconciliation

Passport fully automates reconciliation from authorization to funds settlement, enabling reporting of key transaction details.

Fully Native

With our scalable, native platform. There are none of the risks associated with cobbled-together solutions. It’s the only one of its kind in the industry.

Reduced Costs

Reduce friction and automate operations to save time, labor, and money.

Monetize Transactions

Turn transactions into cash flow by monetizing the payment process and adding revenue to your bottom line.

Speed and Security

Trustworthy big bank services and security with greatly increased speed, flexibility, and agility.

Reporting

and BI

Transparent dashboards allow intuitive access, control, and reporting of every penny that moves in and out of your account.

Cash Builder

Effortlessly manage cash from your Passport account, including FDIC-insured savings (subject to FDIC rules), government-backed investments and high-yield opportunities.

Who Can Benefit From a Banking and Treasury Solution?

Big Bank Solutions, Fintech Speed

Unlock your potential with Passport, Priority’s Banking and Treasury Solution. Experience speed, security, and complete control – all within a unified platform tailored to your needs.