Case Study: How One Manufacturer Automated Its Accounts Payable and Reaped the Rewards

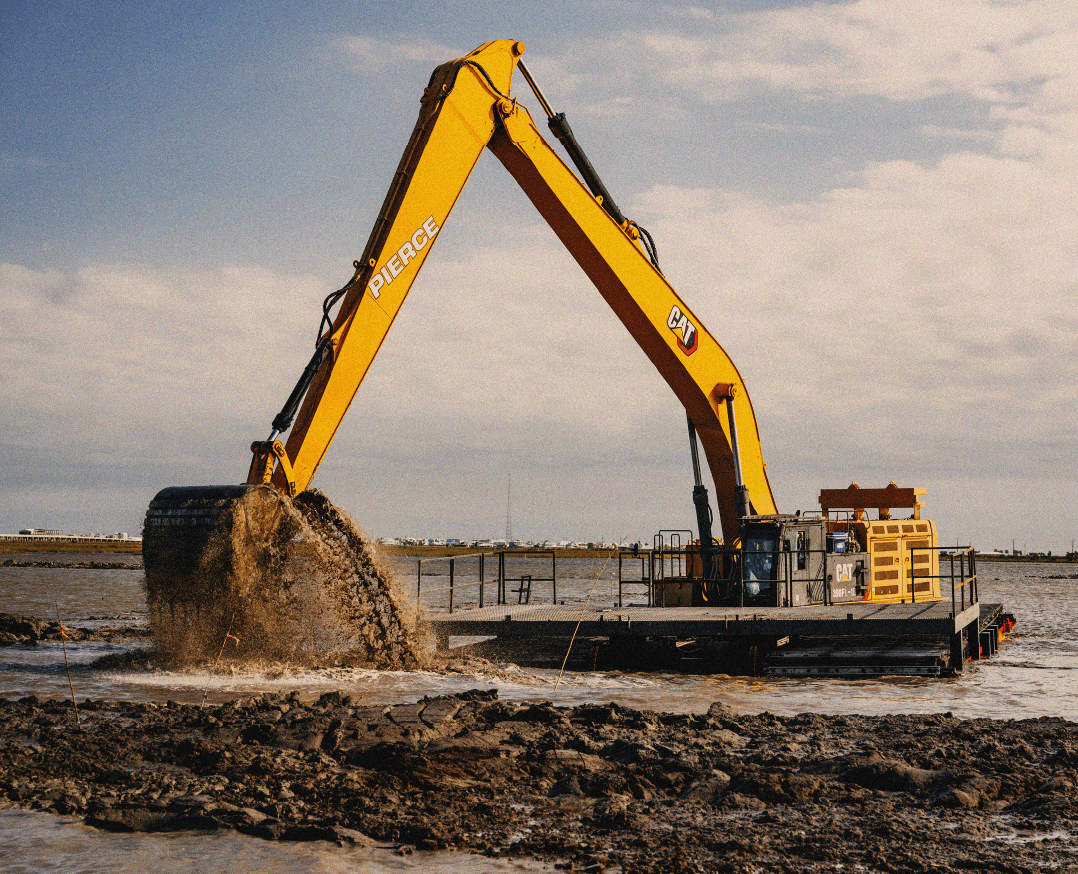

Pierce Pacific, a century-old Oregon manufacturer, faced significant challenges with its manual accounts payable process. From time-consuming check payments to remote work complications, traditional methods were causing delays, errors, and inefficiencies.

In 2022, Pierce Pacific adopted Priority’s CPX electronic payment system, facilitated through their ERP provider, SYSPRO. CPX offered an automated, digitized payment system that seamlessly integrated with their existing ERP infrastructure.

The results were transformative: physical checks vanished, payment processing time plummeted from hours to minutes, and supplier satisfaction soared. But the benefits didn’t stop there. Discover how this accounts payable makeover not only streamlined operations but also turned a cost center into a profit generator.

Read the full case study, and contact Priority to learn more about how CPX can transform your AP processes.