Why It Makes Sense to Transform AP during the COVID-19 Crisis

The impacts of the COVID-19 shutdown have changed the way we live and work. The new “normal” reality of remote work is placing pressure on accounts payable and accounts receivable professionals. The crisis has revealed the deficiencies of existing processes that are heavily dependent on paper and manual intervention.

At this point, you may believe that the disruption of office operations is a one-time episode. Think again. The Centers for Disease Control and Prevention warned that a second wave of the novel coronavirus will be far more dire because it is likely to coincide with the start of flu season.

Now is the time to consider how changes to your AP strategy can ensure your business is prepared to sustain operations now and thrive in the future.

Taking on digital transformation may seem overwhelming when so many pressing needs for surviving the crisis take top priority. The good news is that the right AP solution makes it possible to go digital, integrate payments and actually add new sources of cash flow. You can accomplish this without changing your accounting system or engaging IT resources.

Embrace Digital Automation

Look for ways to reduce dependence on paper based processes, such as receiving paper invoices and writing checks. These archaic practices can be replaced with online solutions that support all supplier payments (even checks) in a single payment instruction file. These solutions enable suppliers to receive electronic payment, so accounts payable and accounts receivable professionals can efficiently manage operations remotely.

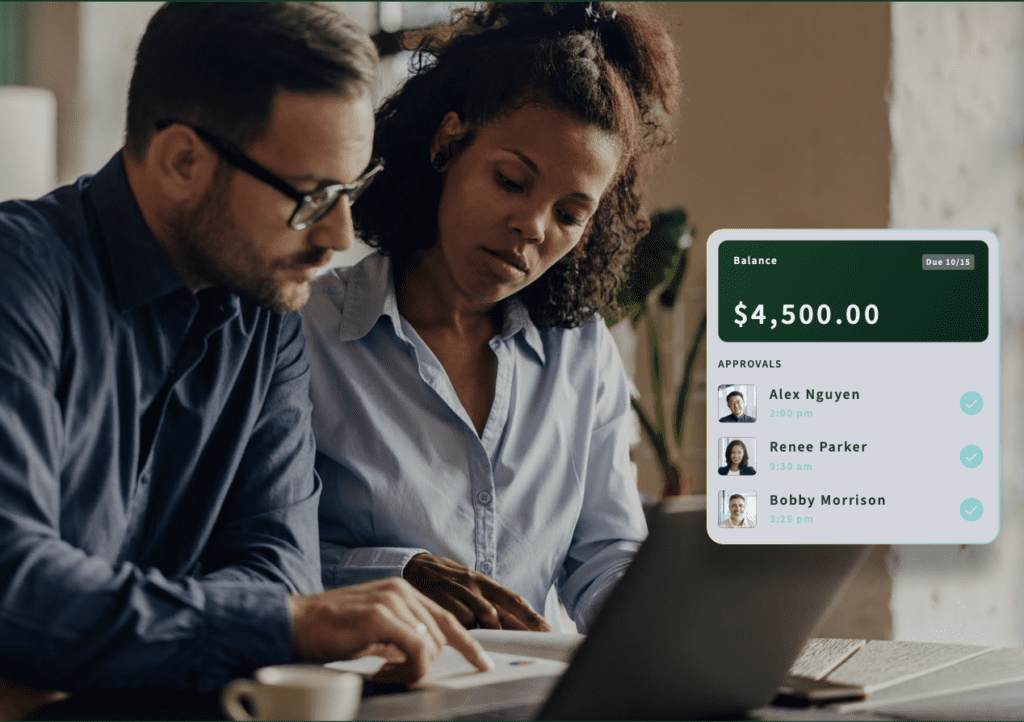

Create Value from Payments

Develop a balanced value proposition with your suppliers around the timing and method of payments to create value for both parties. Integrating virtual card payment solutions can quickly and sustainably generate cash-back incentives. At the same time, you provide your suppliers with assurance and speed of payment in these uncertain times. Optimizing your payment methods will enable you to leverage early payment discounts, avoid interest or late fees and earn cash back on your spending.

Analyze Accounts Payable

You may not be aware of how much your AP is actually costing you. Eliminating manual processes will improve efficiency and enable your team to focus on higher value work. Additionally, a custom analysis of your current supplier spend will show you the “sweet spots” where you have options to pay with virtual card solutions and suppliers can benefit from reduced interchange rate programs.

We can help you identify ways to digitize your AP process, integrate payables and accelerate cash flow with no change to your current ERP or accounting system. Watch this short video to learn more about how our integrated payables platform works and contact us for a complimentary AP spend analysis.